Empowering Voters. Defending Democracy.

The League of Women Voters is a nonpartisan, grassroots organization working to protect and expand voting rights and ensure everyone is represented in our democracy. We empower voters and defend democracy through advocacy, education, and litigation, at the local, state, and national levels.

To become a League member, join one of the 750+ state and local Leagues.

Voting Tools

Register to vote, find your polling place, look up your ballot, and more at VOTE411.org.

In 2020, more than 6 million people found nonpartisan voting resources on VOTE411, including 2.2 million Spanish speakers.

Support the fight for everyone's freedom to vote.

Defending the Right to Vote

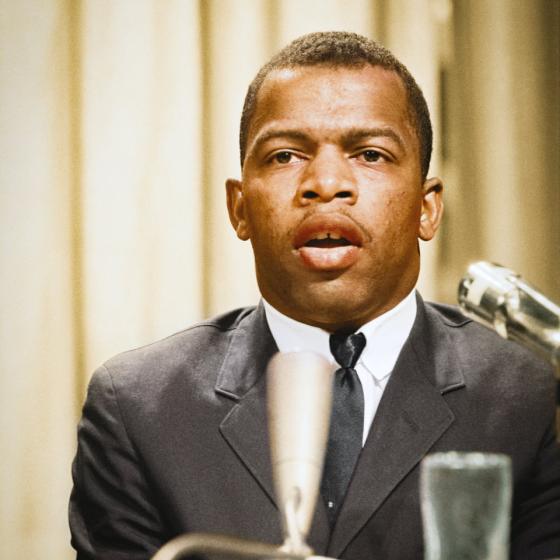

Urge Congress to Support the John R. Lewis Voting Rights Advancement Act

Contact Congress

Urge Congress to Address the Climate Crisis and Protect Our Youth

Contact Your Representatives

Support the Expansion of Voting Rights

Sign the Petition

Demand Equality in Our Constitution

Contact Your Representatives

Tell Your Senators to Pass the Disclose Act

Contact Your Representatives

Demand Bipartisan Cooperation on Voting Rights

Contact Your RepresentativesJoin Your Local League

to advocate for change at the local, state, and national level.

Defending the Right to Vote

In 2020 we protected more than 25 million voters in courts across the nation.

Keeping power in the hands of the people

The Republican-controlled North Carolina Legislature, asserting that state legislatures had exclusive power over redistricting, petitioned the Supreme Court for review, after the state supreme court struck down its redistricting plan.

Standing Up for Reproductive Rights

In March of 2018, the Center for Reproductive Rights filed a lawsuit challenging the fifteen-week abortion ban that was passed by the Mississippi state legislature. The League filed an amicus brief in support of the plaintiffs.

Latest

Fighting for Fair Representation for Black Voters

Plaintiffs sued in federal court to require Alabama to draw a second majority-Black Congressional district under Section 2 of the Voting Rights Act.

The Latest From The League

Sign Up For Email

Keep up with the League. Receive emails to your inbox!

Donate to LWV

Support our work to empower voters and defend democracy through a donation today!